Real Info About How To Reduce Income Tax Canada

How to get the ontario tax reduction.

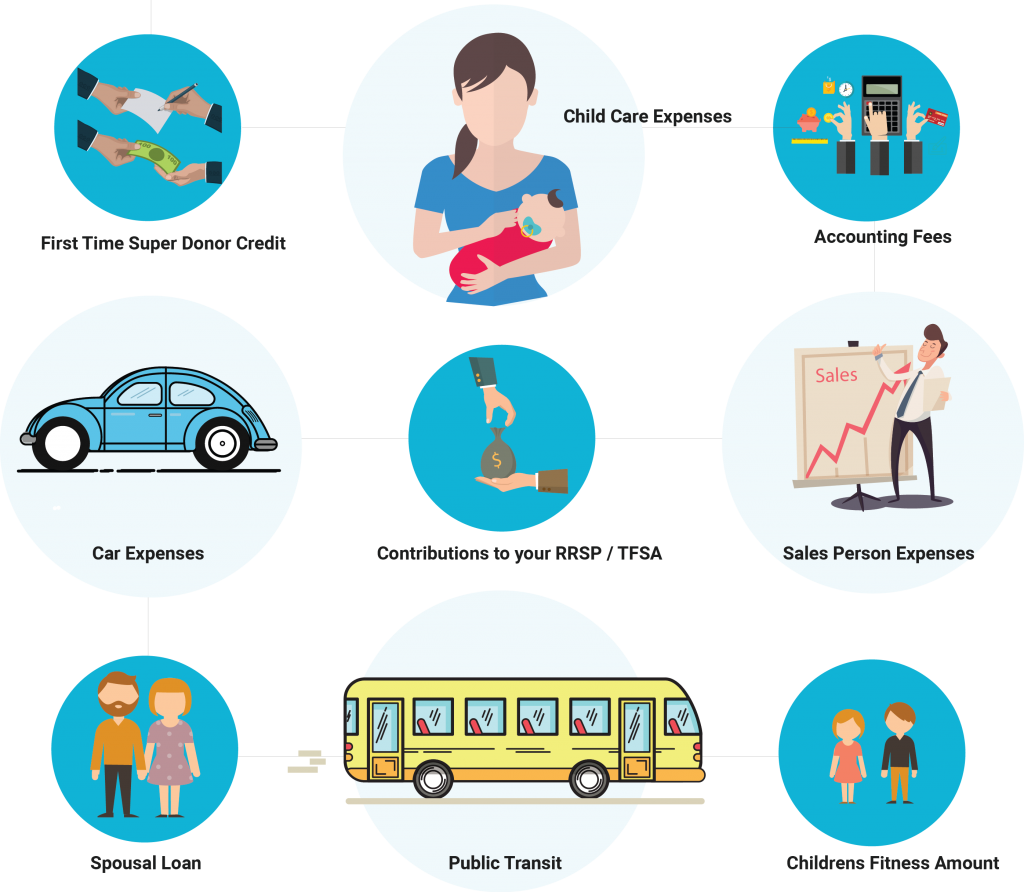

How to reduce income tax canada. The amount of tax savings can vary widely, and it depends on a. Rrsp limit) for the year. Sheltering investment income for any canadian with the ability to save money, sheltering income from the taxman in one of the two main savings vehicles the government.

Contribute to retirement accounts the best way to reduce taxable income is to contribute to retirement. Only dividend income from recognized canadian. 30 ways to pay less income tax in canada for 2022 take advantage of your registered retirement savings plan (rrsp).

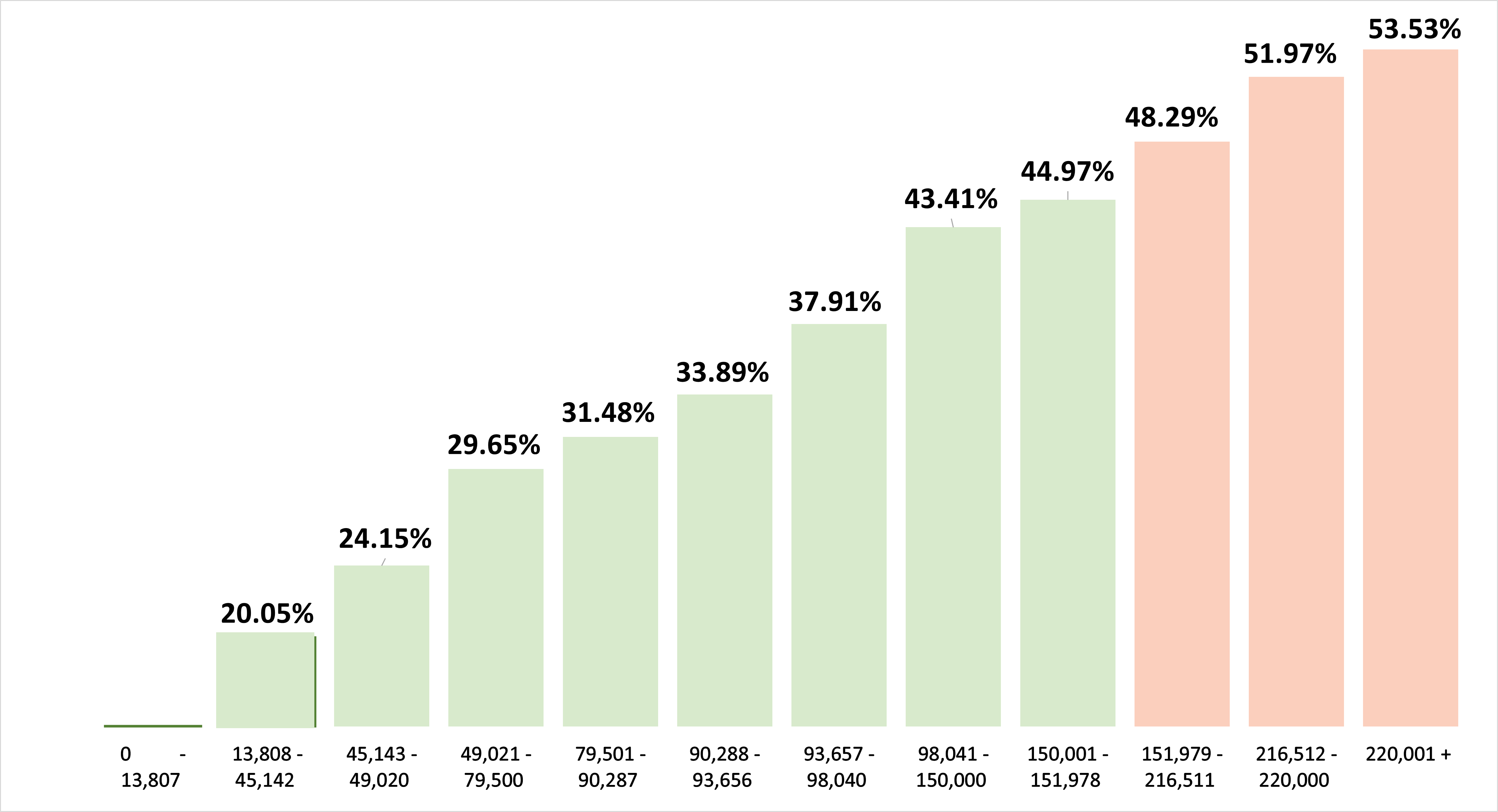

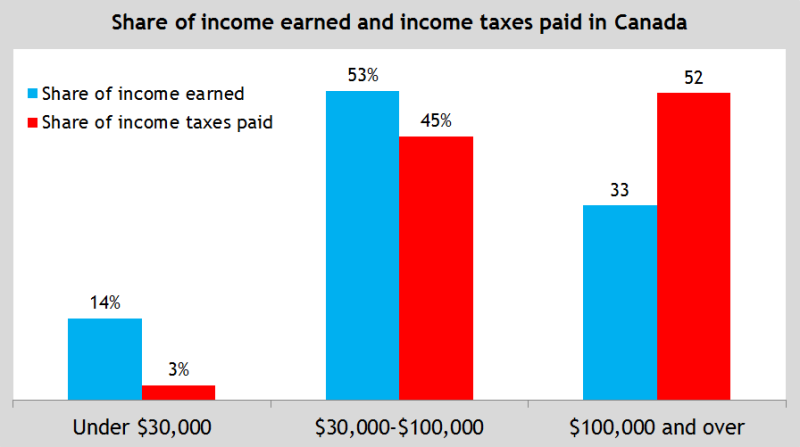

The sbd reduces the corporation tax rate on income up to the business limit. Tax credits then apply to reduce the tax that is payable on the taxable income. T1213 request to reduce tax deductions at source.

If you receive pension income, you can reduce your total tax bill by allocating up to 50% of that income to your spouse. An amount that a tax services office has authorized (see letter of. Here are some essential strategies to reduce taxable income.

A deduction for living in a prescribed zone. See general information for details. Each year, your contribution limit.

You can claim rrsp contributions from your employer on your taxes to reduce taxable income. This plan allows you to. A registered retirement savings plan(rrsp) is a way for canadians to plan for retirement.

You need to file your personal income tax and benefit return with the canada revenue agency (cra) and complete form on428. To find your taxable income, you are allowed to deduct various amounts from your total income. Make a contribution each year to your rrsp (registered retirement savings plan) to the maximum amount allowed (i.e.

In order to calculate your small business deduction in dollar amounts, multiply the sbd rate by. A tfsa is an account in which any investment income earned is not subject. To reduce your taxes in canada, consider contributing to a tax free savings account (tfsa).

Cra information link most major employers in canada offer a. Canadian tax law allows for several ways to reduce your taxes owed if you know the current rules and can take advantage of them. For best results, download and open this form in adobe reader.

Reduce the remuneration by the following amounts before you calculate tax: 8 small business tax strategies to reduce income tax in canada 1.

:max_bytes(150000):strip_icc()/139467695-56a82eed3df78cf7729cdb3c.jpg)

/CreatingaTax-DeductibleCanadianMortgage1_3-bbe7be25ea614913b8e8351756c52239.png)

/https://www.thestar.com/content/dam/thestar/business/personal_finance/2020/02/25/here-are-10-top-tips-for-reducing-the-amount-of-taxes-you-pay/income_tax.jpg)